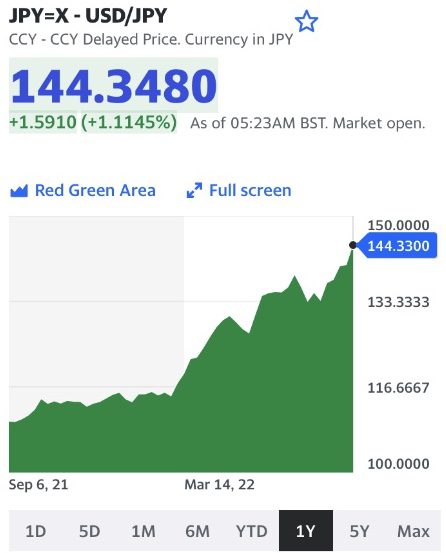

Japan Yen hits 144 to Dollar: Kishida and inaction

Kanako Mita, Sawako Utsumi, and Lee Jay Walker

Modern Tokyo Times

Prime Minister Fumio Kishida took office when the Japanese Yen was 110 to the Dollar. However, eleven months later, the Yen is now 144 to the Dollar. Therefore, a sharp decline under the leadership of Kishida.

Yet, like the Bank of Japan, Kishida is still a bystander and refuses to implement even a fraction of change. The reality is that the ruling Liberal Democratic Party (LDP) generated the highest ratio of debt in the entire world. Thus, Haruhiko Kuroda, the Governor of the Bank of Japan (BOJ), faces an internal economic straightjacket where debt repayments at a higher band will set off alarm bells.

The LDP created three squandered economic decades along with speculators who thought the good times would never end. Hence, the government, local governments, and businesses speculated on the Japanese stock market, real estate, and many infrastructure projects that lacked economic viability. Therefore, once the stock market and real estate sector collapsed (over three decades ago), the rot set in.

Japan continues to hold the highest ratio of debt in the world. Also, stock holdings purchased by the Bank of Japan (BOJ) and the Government Pension Investment Fund (GPIF) are extremely high -compared with other major capitalist nations in the G7. Hence, the news that the BOJ holds 50 percent of all long-term Japanese government bonds isn’t a shock.

In June, the BOJ bought a staggering $120 billion in Japanese Government Bonds (JGBs) to protect its policy of minimal interest rates. The BOJ now owns roughly 50 percent of all JGBs long-term debt. This equates to just below 529 trillion yen – just below 4 trillion dollars.

Hence, with two entities embedded within the system owning one-eighth of all major stocks – and the Bank of Japan buying endless Japanese Government Bonds (long-term debt) – the LDP theory was to manipulate the stock market, boost the share-owning class, and for loans to be made available concerning the moribund interest rate.

In July, Kyodo News reported, “The BOJ’s attempt to defend its 0.25 percent cap on the benchmark 10-year Japanese government bond yield came as rising long-term interest rates overseas pulled their Japanese counterparts higher. The central bank’s bond-buying spree to maintain ultralow rates contrasted with its U.S and European peers, which are moving to tighten their policy, causing the yen to plunge.”

Kishida’s foreign policy is also woeful – it is G7 first at all costs. Thus Japan joined the American-led sanctions on the Russian Federation. Hence, Kishida put “America first” and “Japan last” – similar to many European Union nations. After all, America is blessed with many natural resources – and Japan?

Kuroda said, “We have no choice other than continued monetary easing until wages and prices rise in a stable and sustainable manner.”

It remains to be seen what Yen rate to the Dollar is deemed problematic to the Kishida administration. It might be 145, 150, 155, or even higher. For now (like increasing coronavirus deaths under Kishida), Kishida is taking “the wait and see approach.”

Kishida and Kuroda understand the aftershocks of debt repayments if interest rates were raised like in America. Hence, under the prevailing conditions, the economic straightjacket continues.

Kishida took power approximately 11 months ago. Since then, the majority of deaths from coronavirus (Covid-19) have occurred under Kishida, 91 percent of all coronavirus infections, and the Yen is now 144 to the Dollar after being 110 when he took power. Also, unlike Shinzo Abe’s administration which was favorable to the Russian Federation – even this was destroyed within a few months by Kishida.

Kishida hopes the Yen will strengthen naturally without any policies to counter it. Similar to Kishida waiting for the coronavirus to naturally fade by itself (irrespective if the deaths keep ticking).

Kishida’s main focus is to double the military budget and negate responsibility for anything serious (debt, coronavirus, and the sliding Yen).

PLEASE DONATE TO HELP MODERN TOKYO TIMES

Modern Tokyo News is part of the Modern Tokyo Times group

DONATIONS to SUPPORT MODERN TOKYO TIMES – please pay PayPal and DONATE to sawakoart@gmail.com

http://moderntokyotimes.com Modern Tokyo Times – International News and Japan News

http://sawakoart.com – Sawako Utsumi’s website and Modern Tokyo Times artist

https://moderntokyonews.com Modern Tokyo News – Tokyo News and International News

PLEASE JOIN ON TWITTER

https://twitter.com/MTT_News Modern Tokyo Times

PLEASE JOIN ON FACEBOOK